Reviewed by a Qualified Accountant

This content has been reviewed by our qualified chartered accountants. However you should always check with a professional (like us!). If you have any questions at all, don’t hesitate to get in touch.

Navigate the complexities of UK Child Benefit with our easy-to-use calculator. Designed for families across the United Kingdom, this tool swiftly determines your potential Child Benefit entitlement, helping you understand your financial support for raising children. Whether you’re expecting your first child or planning your family’s finances, our calculator offers clear, instant insights to support your budgeting. Simplify your benefit management and make informed decisions with confidence.

Your situation

Tax and profit

-

Full Annual Benefit£0

-

Actual Benefit£0

-

Tax to Repay£0

-

Net Benefit£0

What is Child Benefit?

Child Benefit is a regular payment from the UK government to help with the costs of raising children. It’s available to those responsible for bringing up a child who is:

- Under 16 years old

- Under 20 if they remain in approved education or training

Key points about Child Benefit include:

- Only one person can claim Child Benefit for a child

- There’s no limit to the number of children you can claim for

- You can choose to receive payments or opt out while still claiming other advantages

By claiming Child Benefit, you receive:

- A regular allowance for each child, typically paid every 4 weeks

- National Insurance credits that count towards your State Pension

- A National Insurance number for your child automatically issued before they turn 16

Importantly, even if you choose not to receive Child Benefit payments due to the High Income Child Benefit Charge, it’s still advisable to make a claim. This ensures you don’t miss out on valuable National Insurance credits, which can protect your State Pension if you’re not working or not earning enough to pay National Insurance contributions.

Child Benefit plays a crucial role in supporting families and safeguarding your future financial security. Our calculator can help you understand your entitlement and make informed decisions about your claim.

Child Benefit Rates and Eligibility

Child Benefit in the UK is paid at two different rates:

- £25.60 per week for the eldest or only child

- £16.95 per week for each additional child

These payments are typically made every four weeks. It’s crucial to inform the Child Benefit Office if you receive an incorrect amount.

Family Circumstances and Child Benefit

- Separated Families: If parents live apart, each can claim the higher rate (£25.60) for the eldest child in their care. Additional children receive £16.95 each.

- Blended Families: When families join together, only one claim at the higher rate (£25.60) is allowed for the eldest child in the household. All other children receive £16.95 each.

- Changes in Circumstances: It’s essential to report any changes in your family situation to ensure accurate payments and avoid potential overpayments.

High Income Child Benefit Charge

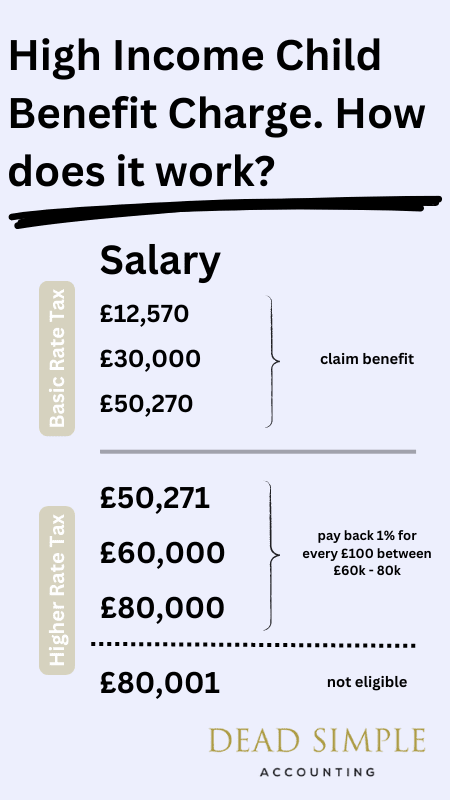

If you or your partner has an ‘adjusted net income’ over £60,000 per year, you may be subject to the High Income Child Benefit Charge:

- This charge applies to the partner with the higher income if both earn over £60,000.

- The charge increases gradually for incomes between £50,000 and £60,000.

- For incomes of £80,000 or more, the charge equals the full Child Benefit payment.

You can use the official Child Benefit tax calculator to determine if you’re affected and estimate the charge. Even if you’re liable for this charge, you can still claim Child Benefit to receive other advantages like National Insurance credits, but opt out of receiving payments.

Important Considerations

- Child Benefit payments count towards the benefit cap, potentially affecting other benefits you receive.

- You must complete a Self Assessment tax return each year if you’re liable for the High Income Child Benefit Charge.

- You can choose to claim Child Benefit but opt out of payments to avoid the charge while still receiving National Insurance credits.

Understanding these aspects of Child Benefit can help you make informed decisions about your claim and manage your family finances effectively.