Please note that we only work with UK residents.

OnlyFans has surged in popularity over the last couple of years, and has allowed many people to make a highly profitable and sustainable living from the comfort of their own homes.

If you’re lucky enough to be one of these people, it’s important to recognise that this is a form of taxable income. This means that you will have to register as self-employed and submit a yearly self-assessment tax return.

Filing your paperwork and staying on top of your taxes may sound pretty boring in comparison to your usual day to day activities, so why not let us work out the kinks?

Why Use Dead Simple Accounting

Dealing with finances is no easy feat considering the amount of paperwork and legalities involved. Dead Simple Accounting leaves you to take care of your business, while we take care of the boring stuff.

We work with lots of influencers and content creators, and know the challenges they may face, as well as all the possible expenses you could claim. We can guide you through the entire process, from registering as self-employed to completing your self-assessment and filing them with HMRC.

We also offer services that help to forecast any risks that stand in the way of your goals.

Don’t want to take our word for it? Let our five-star ratings across Google and Facebook do all the talking.

What to Consider?

There are two different types of taxes that you may be subject to when earning from OnlyFans: income tax and VAT. Regarding VAT, in the words of HMRC:

“You must register for VAT if your VAT taxable turnover goes over £85,000 (the ‘threshold’), or you know that it will. Your VAT taxable turnover is the total of everything sold that is not VAT exempt.“

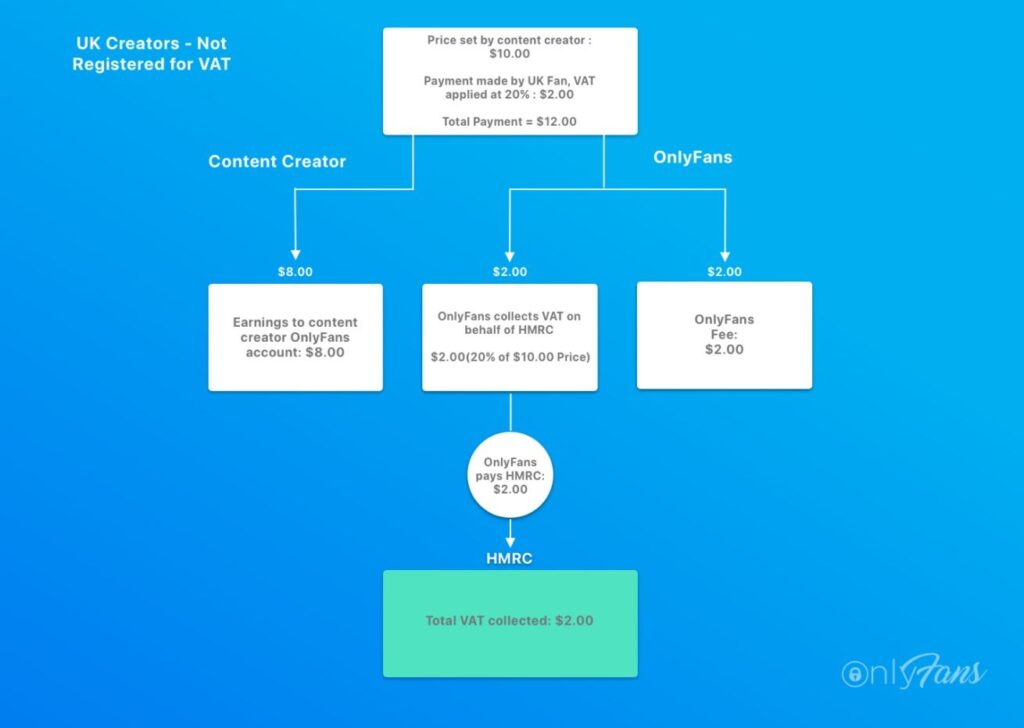

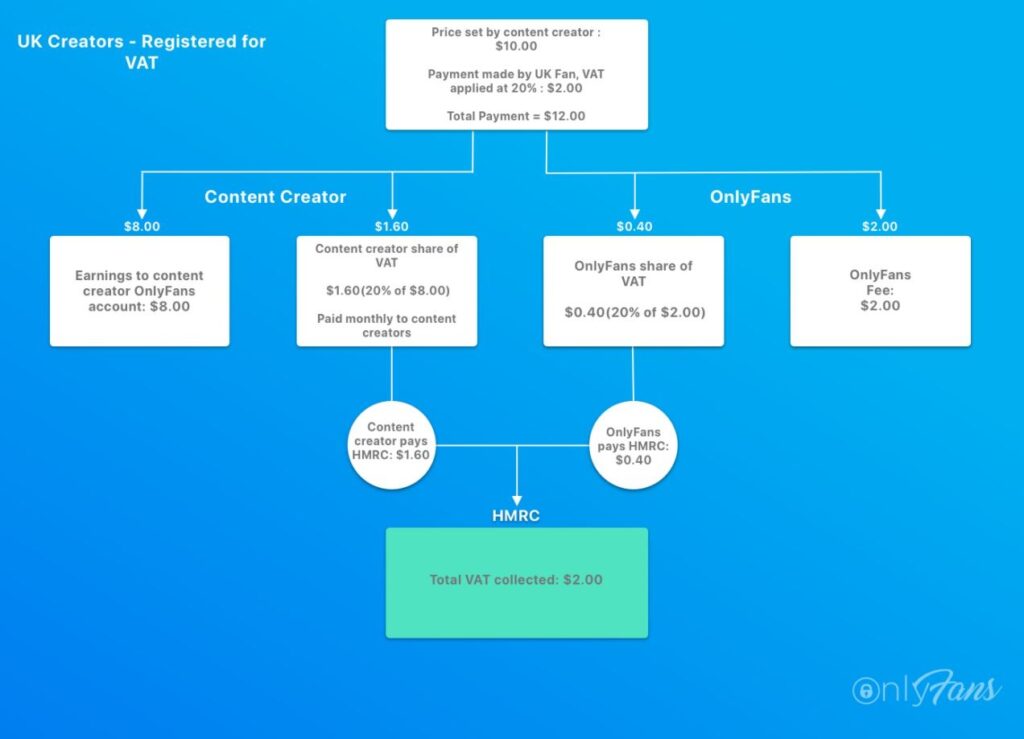

UK VAT is, unfortunately, very complicated. To help explain the process, OnlyFans put together two diagrams illustrating what happens to creators who aren’t and are not registered.

If you aren’t registered for VAT:

If you are registered for VAT:

While you need to register for VAT if your taxable turnover is above £85,000 across a 12 month period, you can also voluntarily register for VAT if you earn less than that. It could be that this allows you to reclaim VAT back on your business expenses, but this is a complicated area to navigate.

Informing OnlyFans that you’re VAT registered is simple, you just need to provide them with your VAT registration number. They’ll then update your records and generate a monthly VAT statement which can be found within your profile, allowing you to send this to your accountant each month.

Our Pricing

At Dead Simple Accounting we charge just £275 including VAT for self-assessment tax returns, and can take you through the entire process.

If you’re interested in other services, such as setting up a company or payroll, head over to our quote page for a free and instant estimate.

The reviews speak for themselves

See what our clients have to say about us

What Expenses can OnlyFans Creators Claim?

Claiming expenses at the end of the year is an important aspect of accounting for OnlyFans creators as it enables you to cover up a lot of your costs. The key lies in being able to accurately produce receipts as proof of your spending solely for your business. Our qualified team of accountants can guide you through the different expenses that you can include on your tax return to save on payments. The following are expenses that an OnlyFans creator may claim:

- Gym membership

- Props

- Lighting & accessories

- Toys

- Beauty products & treatments

- Lingerie

- A portion of your rent and utility bills if you film/create at home

- Advertising

- Travel

- Dry cleaning

- Photography equipment

- Office supplies

- Mobile phone and bills

- Laptops & Computers

- And more

Generally speaking, if something is solely for business use then it’s likely it can be claimed as an expense. It’s important that you keep on top of your paperwork, so ensure you save all receipts and invoices and snap a picture of them as a backup.

Take a full look at our expenses for OnlyFans Creators.

OnlyFans Accounting FAQs

Not everyone needs an accountant to file their OnlyFans taxes, however, an accountant makes the entire process very simple. They’ll also help reduce your tax bill, and ensure you’re aware of what you owe to HMRC and when.

Yes. If you are on OnlyFans, you are not employed by them. You’re self-employed (potentially through a company) and must notify HMRC and pay tax on any income exceeding £12,750.

HMRC lets you earn £1,000 tax free through platforms like OnlyFans. Anything above that needs to be reported to HMRC by you. OnlyFans does not report to HMRC about your earnings.

You don’t have to put your real occupation for tax purposes, for example, you could put “content creator”.

You are only required to register for VAT if your self-employed earnings (including from OnlyFans) for the last 12 months was over £85,000.

Useful Resources

These days there’s an abundance of tools and resources at your disposal, software that handles your invoices and expenses, to mobile based banks that cut the boring paperwork.

We only work with the best of the best, and have partnered with several big names to offer you various goodies when signing up.