Mortgage Lenders nearly always require you to provide your HMRC SA302 & Tax Year overviews to support and evidence the income you have earned and declared for your employed, self employed, dividend and property related remuneration.

So, how can you access this information?

HM Revenue & Customs (HMRC) provides the information online. or paper originals will continue to be acceptable if you do not have access to the internet.

These can be ordered by you (or your Accountant).

Read below to see how to view and download the necessary tax documents and proof of income.

SA302s (Tax Calculations)

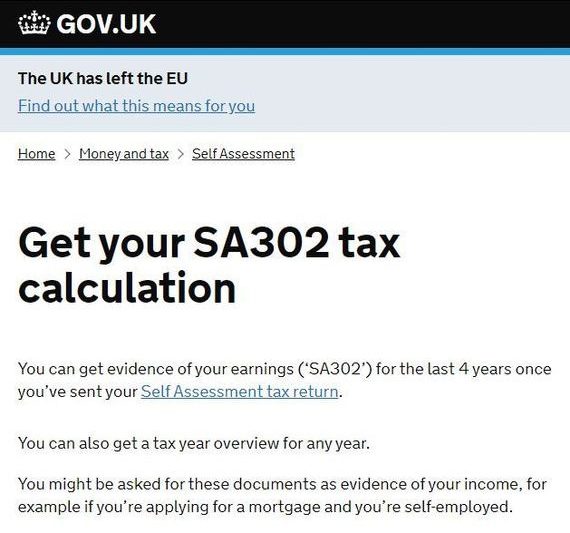

- Log into the HMRC online account (go to https://www.gov.uk/sa302-tax-calculation)

- Scroll down and Log In

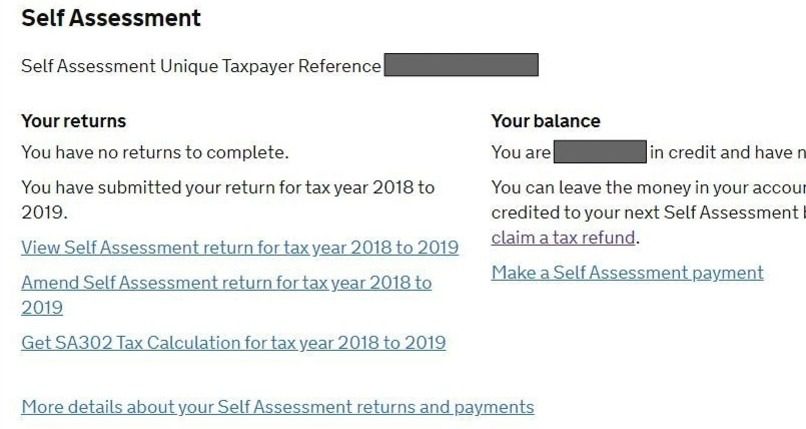

- Select ‘Self Assessment’ (if you are only registered for Self Assessment then you will automatically be directed to this screen)

- Follow the link ‘Get SA302 Tax Calculation for tax year 20xx to 20xx’

- Follow the link ‘Continue to your SA302’

- Click the ‘view your Calculation’ link

- Scroll to the bottom of the page

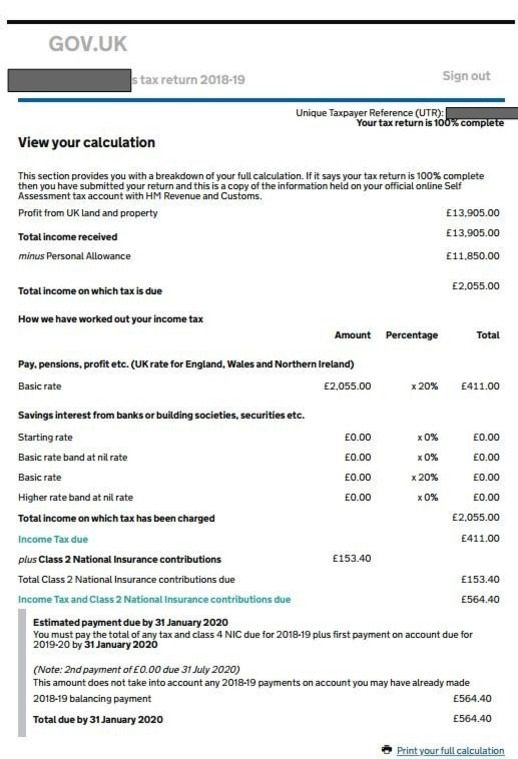

- Click on ‘View and print your calculation’ (should look like this)

- Select ‘Save as PDF’

- Save to a folder

Tax Year Overviews

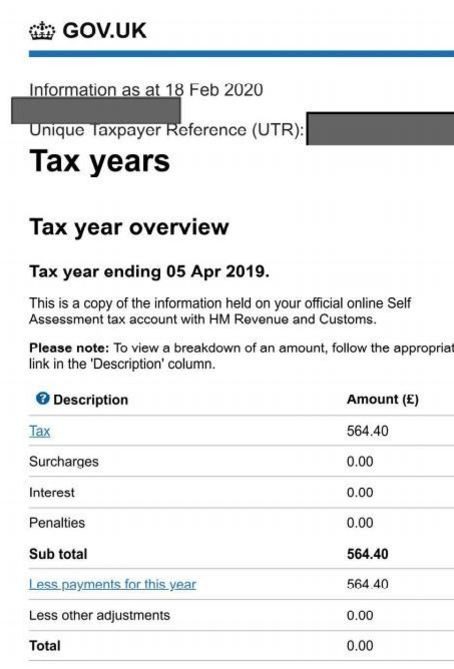

An additional HMRC online document called a Tax Year Overview will be required to verify that the SA302 information is correct, whether using online or paper-based SA302s.

The Tax Year Overview is produced by HMRC after the customer has submitted their self-assessment tax return. It shows the amount of tax due to be paid directly to HMRC or any available amount for a refund for a given tax year.

- Log into the HMRC online account (go to https://www.gov.uk/sa302-tax-calculation)

- Scroll down and Log In

- Select ‘Self Assessment’ (if you are only registered for Self Assessment then you will automatically be directed to this screen)

- Follow the link ‘View Self Assessment return for tax year 20xx to 20xx’

- Select the appropriate tax year you require from the drop down box

- Click ‘Go’

- Scroll down and click on ‘Print your tax year overview’

- Select ‘Save as PDF’

- Save to a folder

Tax Returns / SA100

Your Tax return (SA100) can also be viewed / printed / downloaded from the .gov.uk website too

- Log into the HMRC online account (go to https://www.gov.uk/sa302-tax-calculation)

- Scroll down and Log In

- Select ‘Self Assessment’ (if you are only registered for Self Assessment then you will automatically be directed to this screen)

- Follow the link ‘More details about your Self Assessment returns and payments’

- In the ‘Your returns’ section, click on ‘View Self Assessment return for tax year 20xx to 20xx’ (OR, scroll down and select appropriate year from the Previously Submitted returns’ list)

- IMPORTANT – NOW SELECT ‘TAX RETURN OPTIONS’ from the right hand menu

- Select the appropriate tax year from the drop down menu and click ‘Go’

- Scroll down and click ‘View Return’

- On the left hand menu of the next page, click on on View / Print / Save your return

- Scroll down to the ‘colour copy’ option, and click on ‘Print a colour PDF copy of your return’

- This should then open a .pdf document for you to view

- Save to a folder

… and then don’t forget to Sign Out!

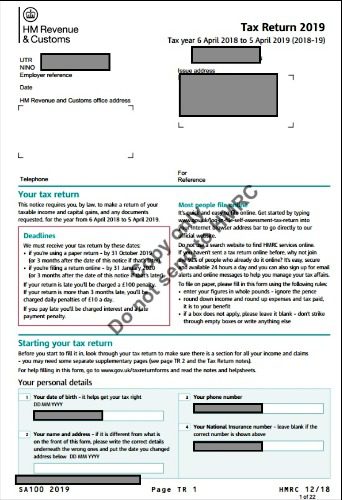

If you follow the above, then your documents will (and must) look like this.

Alternative formats and styles may not be acceptable to a mortgage lender.

Tax Calculation Document

Full Tax Return SA100 Document

Tax Year Overview Document

HMRC Entry Age